Explain the Main Difference Between Fiscal Policy and Monetary Policy

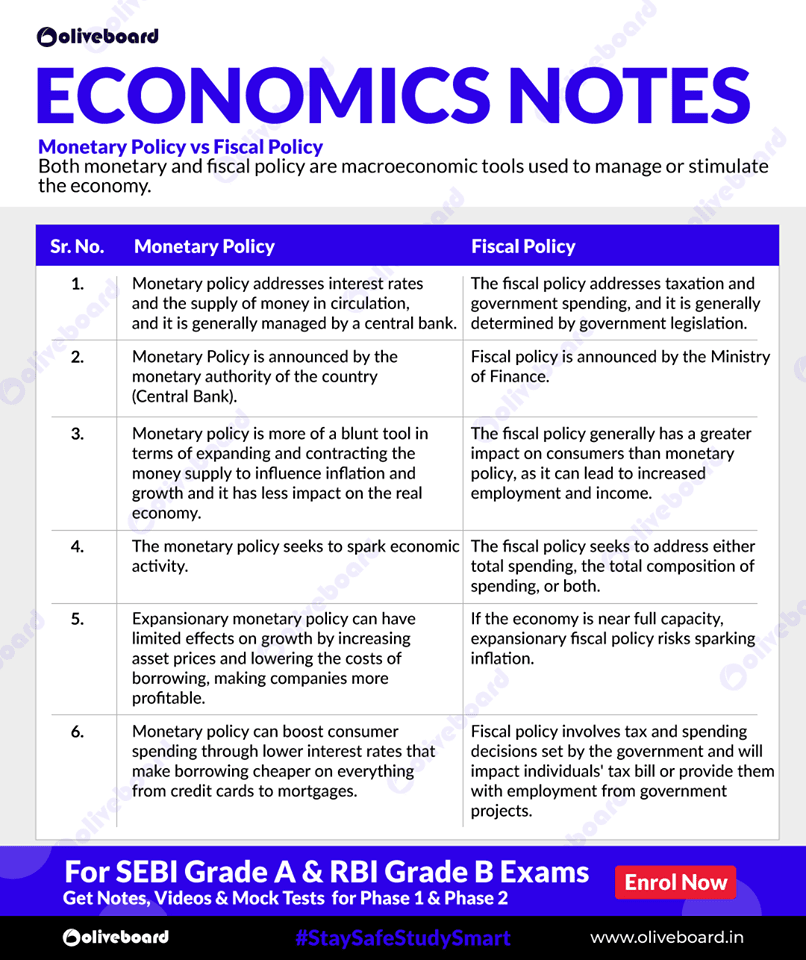

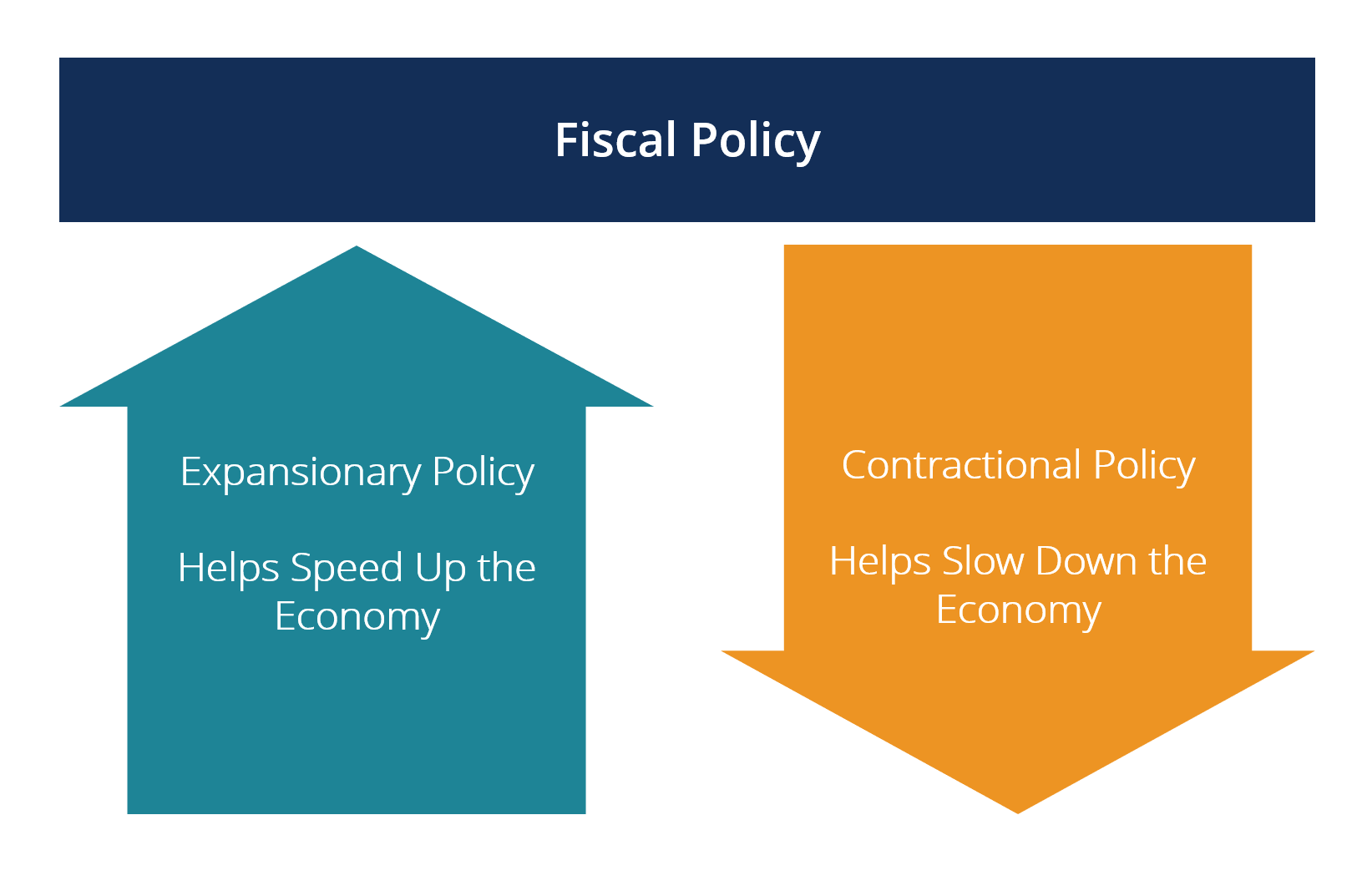

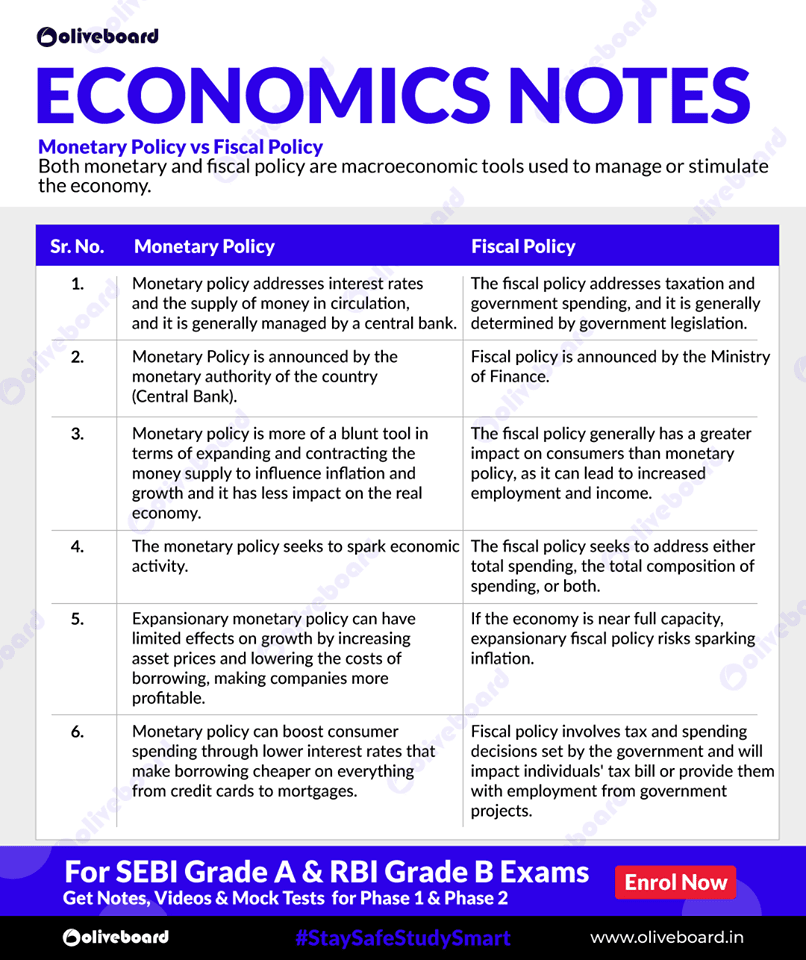

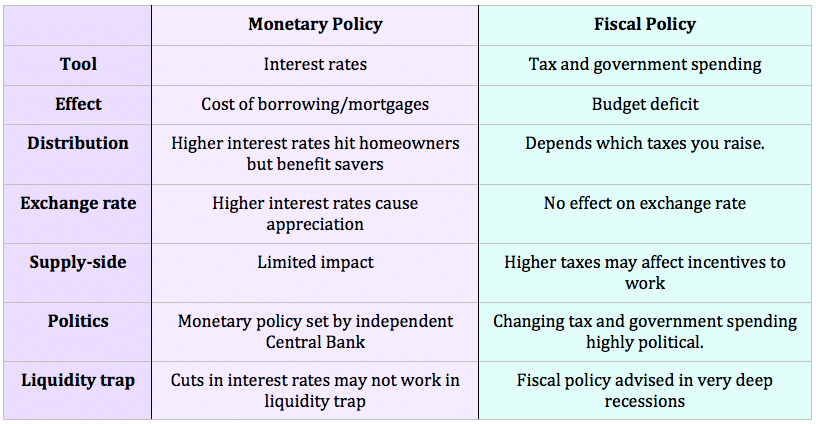

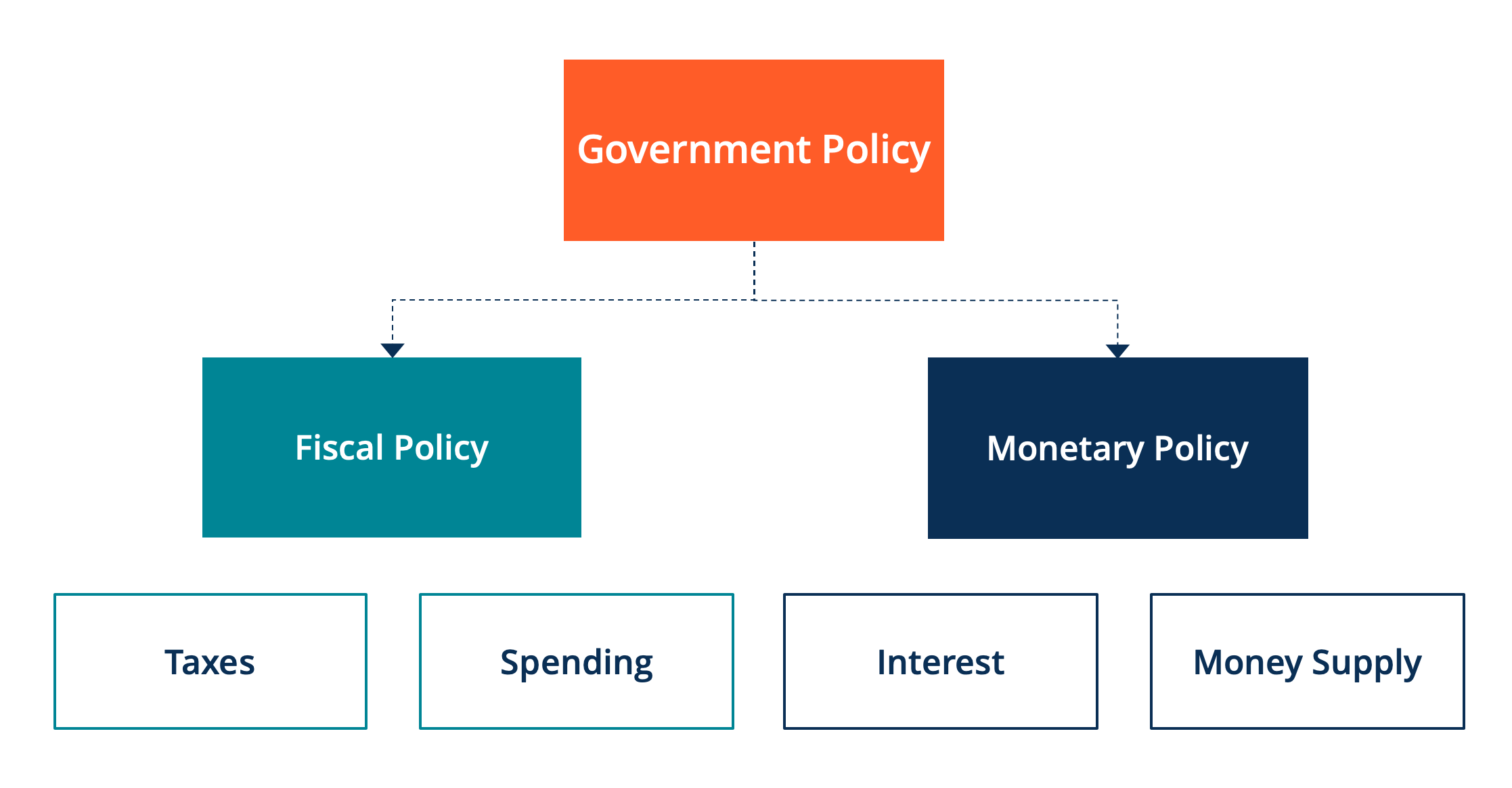

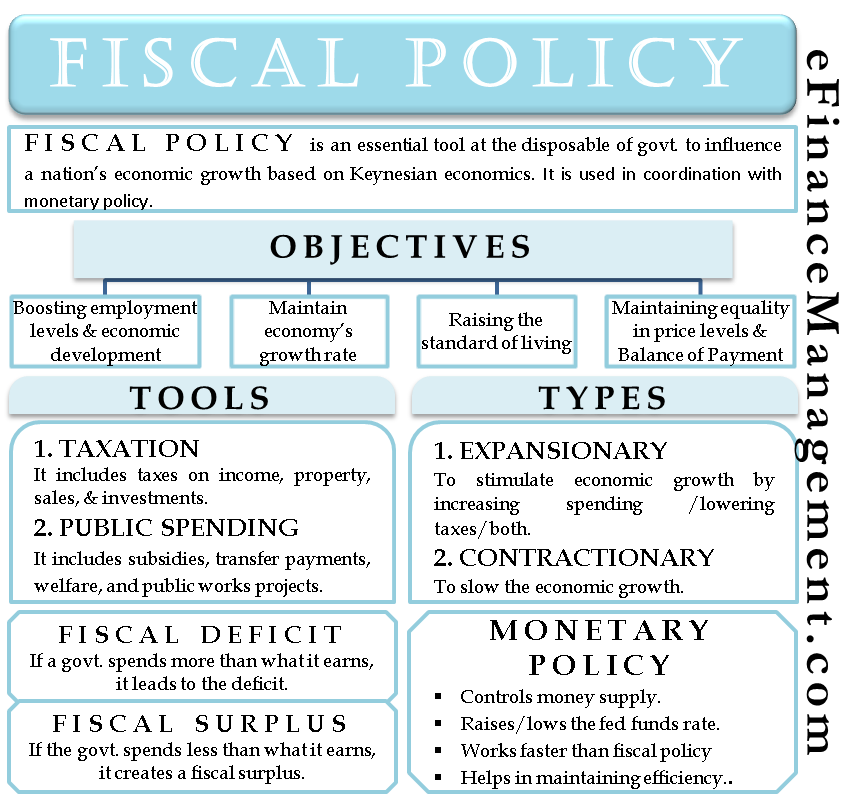

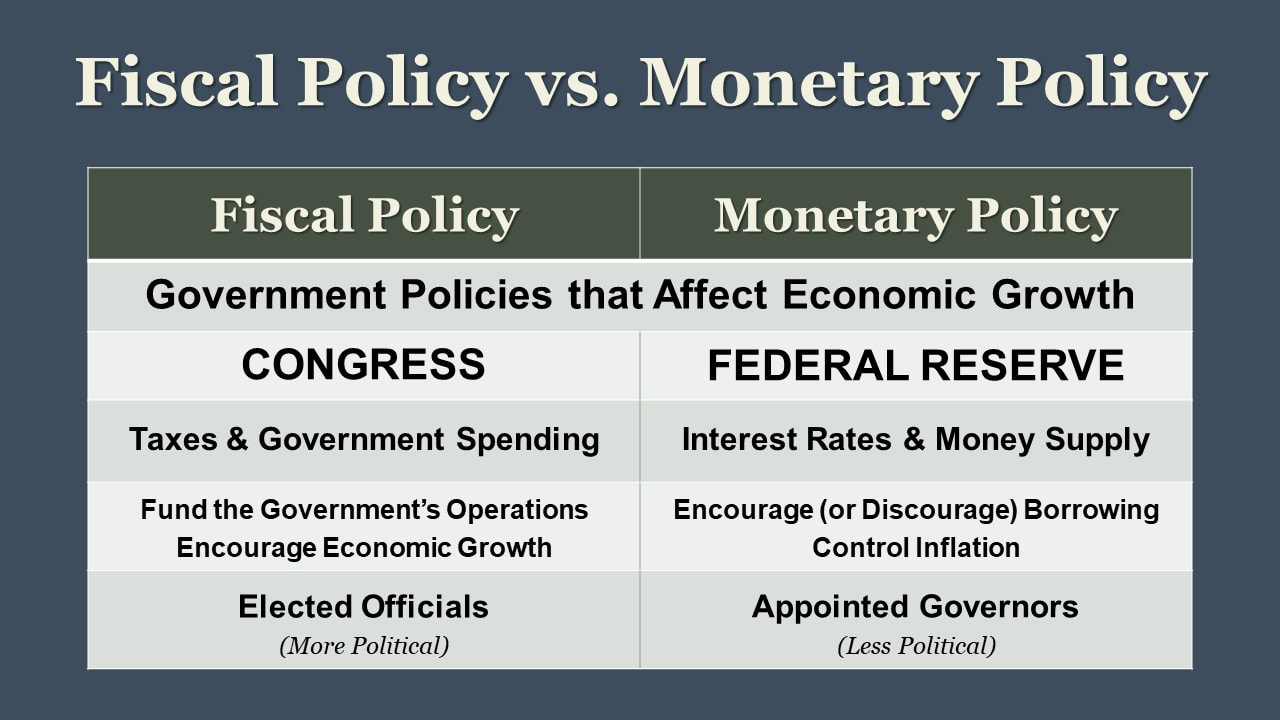

The largest difference in the way that the fiscal policy is separate from the monetary policy is in the way that fiscal policy manipulated the demand within any given economic structure while monetary policy focuses on the supply in an economy through the control of interest rates and printing. Examples of Fiscal policy include.

Monetary Policy Vs Fiscal Policy Difference And Comparison The Investors Book

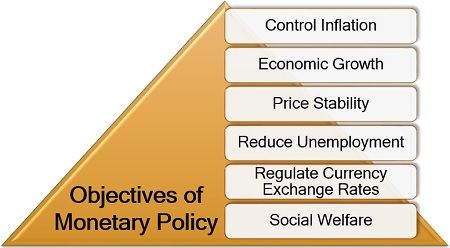

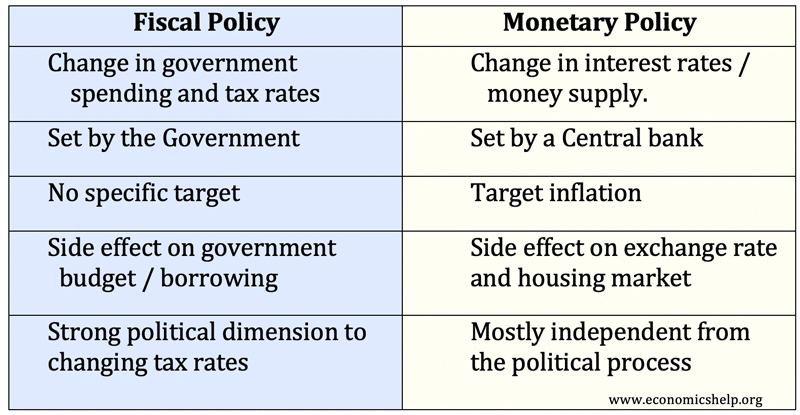

Monetary policy targets inflation in an economy.

. Fiscal policy and monetary policy are importantly different in that they affect interest rates in opposite ways. The official growth rate fell 132 MONETARY AND ECONOMIC STUDIES SPECIAL EDITIONDECEMBER 2002 Monetary and Fiscal Policy in the European Monetary Union Figure 4 Money Growth and Inflation Percent 40 35 30 25 20 15 10 05 00 05 10 15 Jan. Monetary policy refers to the actions of central banks to achieve macroeconomic policy objectives such as price stability full employment and stable economic growth.

Fiscal policy is controlled by the ministry of finance of the country. Between monetary and fiscal policy the former is generally viewed as having the largest impact on the economy while fiscal policy is seen as being the less efficient way to influence growth trends. Explain the difference between monetary and fiscal policy.

Explain the difference between Fiscal Policy and Monetary Policy. Fiscal Policy gives direction to the economy. Monetary and fiscal policy are both tools used to influence an economys performance and achieve certain goals.

On the other hand Monetary Policy brings price stability. On the other hand monetary policy is managed by the countrys Central Bank. The fiscal policy do have the political influence whereas no such political influence is made on the monetary policy.

1 Explain the difference between monetary and fiscal policy. 1998 July 1998 Oct. Fiscal policy refers to the tax and spending policies of the federal government.

Fiscal policy has an impact on the budget deficit. Interest rates are controlled to promote overall economic growth. Fiscal policy is when the government changes taxes on government expenditures to influence the level of economic activity.

Amount of government spending. They do however differ in their approach and how they operate. But the monetary policy in United States of America is handled by the Federal Reserve System FED.

The main and most obvious difference between monetary and fiscal policy is that monetary policy is set by the central bank and fiscal policy is implemented by the government. Fiscal Policy is made for a short duration normally one year while the Monetary Policy lasts longer. 1999 July 1999 Oct.

In the case of the UK monetary policy is decided upon by the Bank of England which since 1997 has been independent from the government. The political process can select for monetary policy makers who will accommodate fiscal needs even without overt coordination between fiscal and monetary agents. Is the process by which the monetary authority of a country controls the supply of money often targeting a rate of interest to attain a set of objectives oriented towards the growth and stability of the economy.

The fiscal policy ensures the overall well-being of the economy. Discuss the Feds monetary tools quantitative and qualitative. Monetary policy controls the supply of money in the nation.

Monetary policy has an impact on the borrowing in an economy. Learning the difference between fiscal policy and monetary policy is essential to understanding who does what when it comes to the federal government and the Federal Reserve. Similar to Monetary policy Fiscal policy stabilize business cycle reduce unemployment and inflation and promote economic growth.

After reviewing the previous years results fiscal policy is formed every year. Monetary policy is when the Federal reserve bank attempts to influence the money supply in order to stabilize the economy. What are some of the tools used to implement fiscal policy.

Cite at least two specific examples of action taken to implement fiscal policy or at least attempted in the past year. 2 Why does the Fed adjust the money supply. Fiscal policy is when the government changes taxes on government expenditures to influence the level of economic activity.

Monetary and Fiscal Policy Interact to Affect the Economy An important aspect of monetary and fiscal policies is that neither occurs in a vacuum. The short answer is that Congress and the administration conduct fiscal policy while the Fed conducts monetary policy. 4 Discuss the Fed have global responsibilities formal and informal.

But fiscal policy is undertaken by state and local government to stabilize local economies. Monetary policy is a policy set by a countrys central bank to keep the flow of money in the market and inflation in check. ADVERTISEMENT Comparison Video Samantha Walker.

Therefore monetary policy is a subset of fiscal policy. Fiscal Policy Generally speaking the aim. 5 What is tfe Feds track record over the years.

Monetary policy seeks to spark economic activity while fiscal policy seeks to address either total spending the total composition of spending or both. What is a Monetary policy. Fiscal policy does not have any specific target.

Fiscal policy gives the direction of economy of a nation. Monetary policy is when the Federal reserve bank attempts to influence the money supply in order to stabilize the economy. Monetary policy by construction lowers interest rates when it seeks to stimulate the economy and raises them when it seeks to cool the economy down.

These are basic differences between fiscal policy and monetary policy of a country. The fiscal policy is announced on a yearly basis whereas the monetary policy is for the more time as it mostly changes with a change in the economic condition of the country. Fiscal policy is concerned with the taxing and spending actions of the government while monetary policy is concerned with two main areas management of interest rates and total View the full answer.

In other words fiscally accommodative central bankers are adaptively successful in the political environment of fiscalmonetary decision making. Fiscal policy relates to the economic position of a nation. Fiscal Policy is concerned with government revenue and expenditure but Monetary Policy is concerned with borrowing and financial arrangement.

It helps to limit the flow of money in order to reduce problems of unemployment inflation and to stabilize business cycle. Monetary policy focuses on the strategy of banks. This is done by Congress and the President actions.

What Is The Difference Between Fiscal Policy And Monetary Policy Sarthaks Econnect Largest Online Education Community

Fiscal Policy Overview Of Budgetary Policy Of The Government

Monetary Policy Vs Fiscal Policy Just Read

Monetary Policy Vs Fiscal Policy Know The Difference Here

Monetary Policy Vs Fiscal Policy Economics Help

Difference Between Fiscal Policy And Monetary Policy Explained In Easy Language

Fiscal Policy Overview Of Budgetary Policy Of The Government

What Is Fiscal Policy Its Objectives Tools And Types

Difference Between Monetary And Fiscal Policy Economics Help

Economic Policy In Emu What Role For Fiscal And Monetary Policy Which Has More Scope Left How To Combine Them Suerf Policy Notes Suerf The European Money And Finance Forum

Monetary Vs Fiscal Policy What S The Difference Wealthify Com

Difference Between Monetary And Fiscal Policy Economics Help

Monetary Policy Vs Fiscal Policy Prosperity Advisors

![]()

Education Resources For Teachers Schools Students Ezyeducation

How Does Fiscal And Monetary Policy Impact Your Personal Finance

Monetary And Fiscal Policy Video Khan Academy

Difference Between Fiscal Policy And Monetary Policy With Comparison Chart Key Differences

Fiscal Policy Vs Monetary Policy Ap Government Review Tomrichey Net

Monetary Policy Dominated The Last Decade What S Ahead Global X Etfs

Comments

Post a Comment